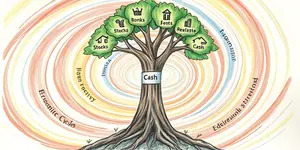

As financial markets evolve at breakneck speed, investors face a pivotal choice: adhere solely to conventional instruments or embrace digital innovations.

By merging the strengths of both worlds, individuals and institutions alike can build future-proof organizations and portfolios, ready for tomorrow’s challenges.

Traditional asset classes—stocks, bonds, and real estate—have underpinned wealth building for decades. They offer stability, regulatory clarity, and familiar risk-return profiles for seasoned investors. Yet they can suffer from access barriers, limited liquidity windows, and fixed fractional thresholds.

In contrast, digital assets—cryptocurrencies, tokenized equities, blockchain-based products—deliver 24/7 trading and novel investment opportunities. They allow programmable features, instant settlement, and global participation that transcend market hours and geography.

Integrating blockchain and tokenization directly can be daunting for legacy institutions. Fortunately, strategic partnerships with digital asset firms provide turnkey solutions without massive in-house development. By collaborating with specialized providers, banks and asset managers can maintain compliance and access advanced tools seamlessly.

Digital-Assets-as-a-Service platforms streamline compliance, custody, and payments through plug & play integration, orchestrating workflows for KYC, AML, and transaction monitoring. This approach reduces operational costs and complexity while supporting rapid market entry and scaling across jurisdictions.

Blending traditional and digital assets unlocks a powerful synergy:

By harnessing both worlds, investors enjoy fractional ownership and increased market liquidity, all while adhering to established regulatory frameworks.

While the blended model is compelling, it introduces new challenges. Distributed ledger technology can be subject to cybersecurity threats, smart contract vulnerabilities, and extreme volatility in nascent token markets. Organizations must build robust governance frameworks, stress-test scenarios, and implement continuous auditing.

Moreover, the legal landscape for digital assets remains in flux. Regulators worldwide are rolling out new requirements around reporting, custody, and consumer protections. Institutions must stay abreast of changes to avoid fines, reputational damage, or forced divestment from promising markets.

A deliberate, modular approach ensures agility:

Drawing parallels from blended learning models, this strategy emphasizes flexibility, personalization, and cost optimization. It ensures portfolios remain resilient amid disruptions and ready to seize new opportunities.

Leading financial institutions are pioneering hybrid platforms that enable simultaneous custody and trading of equities and tokens in a single interface. For example, a global bank recently partnered with a blockchain firm to tokenize high-value real estate, opening the market to a broader investor base through fractionalized shares.

Art collectives have also embraced tokenization, converting masterpieces into digital certificates that trade on specialized marketplaces. This innovation not only enhances liquidity but also democratizes ownership, allowing art enthusiasts worldwide to participate in high-end cultural investments.

In an age where change is the only constant, combining traditional finance with digital innovation offers a robust pathway to future-proof organizations and portfolios. By leveraging partnerships, embracing tokenization, and adopting modular platforms, investors can achieve superior liquidity, compliance, and operational efficiency.

Embrace the blended model now to secure your place in the next era of finance—where every asset, whether brick-and-mortar or blockchain-based, works in concert to build sustainable wealth.

References