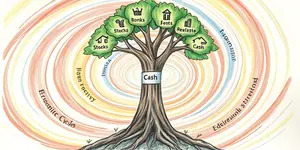

Building a resilient portfolio demands both a stable foundation and the agility to seize market opportunities. By combining a robust core with nimble tactical tilts, investors can pursue growth while managing risk effectively.

Core holdings consist of broad, diversified assets—such as large-cap equities, investment-grade bonds, or index funds—that aim for steady, long-term risk-adjusted returns. These form the anchor of a portfolio, reflecting strategic asset allocation aligned with an investor’s risk tolerance and objectives.

Tactical tilts are shorter-term, dynamic shifts designed to capture market inefficiencies or trends. Whether through sector ETFs, thematic funds, or concentrated positions, these tilts can exploit emerging themes like AI, commodities during inflation, or regional opportunities.

In the core-satellite model, roughly core representing 70–80% weight of assets remains stable, while the remaining 20–30% is allocated to tactical satellites. This barbell strategy analogy positions the portfolio’s bulk as the weighty base and satellites as the sharp edge for potential upside.

Combining core holdings with tactical tilts offers several advantages:

Establishing the core typically involves passive vehicles such as ETFs or index mutual funds tracking global equities and high-grade bonds. Real assets like REITs or commodities can be included based on inflation outlook.

For the tactical sleeve, investors select high-conviction themes or sectors. Funding these tilts may require trimming from the core or rotating among satellite themes as convictions change.

Industry consensus supports a satellite allocations up to 30% while reserving 70–80% for core. Data shows the satellite sleeve is more volatile, yet overall portfolio risk stays moderated by the core anchor.

Tools include both passive ETFs for broad exposure and active funds or single-stock positions for tactical bets. The goal is to maintain strategic allocation while overlaying dynamic adjustments as market conditions warrant.

During inflationary cycles, some portfolios increased exposure to commodities and real estate within the core, then deployed tactical tilts into inflation-hedging sectors like energy or Treasury Inflation-Protected Securities (TIPS). This approach captured elevated yields while preserving core diversification.

In the COVID-19 downturn, thematic satellites in biotech and cloud computing outperformed, generating alpha that bolstered overall returns despite underperformance in other tactical positions.

This blended model suits long-term individual investors seeking growth with tactical flexibility, institutional portfolios integrating macro views, and clients with evolving life goals. For accumulation, tilts can focus within asset classes; for distribution, tilts may span across classes.

With rising interest rates reshaping risk dynamics, traditional bonds offer higher yields but lower price appreciation. Inflationary pressures and rapid technology disruption present tactical opportunities in real assets, energy, and AI-driven sectors.

ETFs and index vehicles now provide transparent, liquid means to implement both core and tactical allocations, enhancing agility in shifting environments.

Key terms:

Analogies help clarify the concept: imagine a sports coach changing plays mid-game to exploit weaknesses, or a barbell where the heavy core provides stability and the light end delivers explosive power.

Mixing core holdings with tactical tilts empowers investors to navigate uncertainty with a balanced playbook. By maintaining a stable foundation and dynamic overlay, portfolios can aim for consistent long-term growth while capturing short-term market opportunities.

Discipline in rebalancing, clear conviction criteria for tilts, and ongoing risk management are essential. With this flexible framework, investors can adapt to evolving market landscapes without losing sight of strategic objectives.